AI Wealth Management Assistant

New

LLM Multi-agent RAG Client advisors in wealth management face significant challenges: information overload from market news, inefficient client meetings requiring multiple follow-ups, and error-prone manual trade verification. This project delivers an AI-powered assistant with three integrated modules to transform advisor workflows.

Core Modules

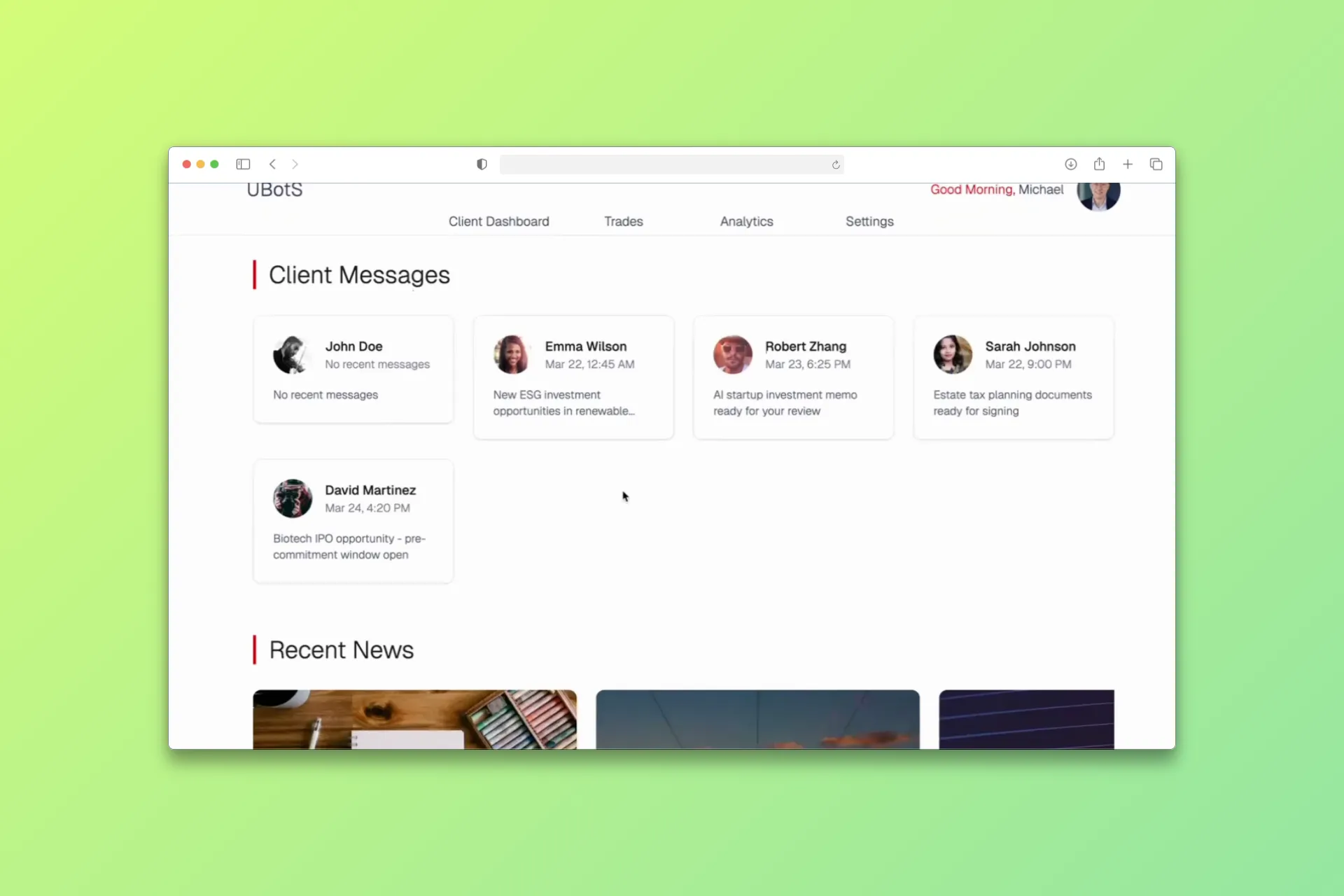

- InfoWeave - Matches market updates and product recommendations to relevant client portfolios using multi-agent LLM architecture

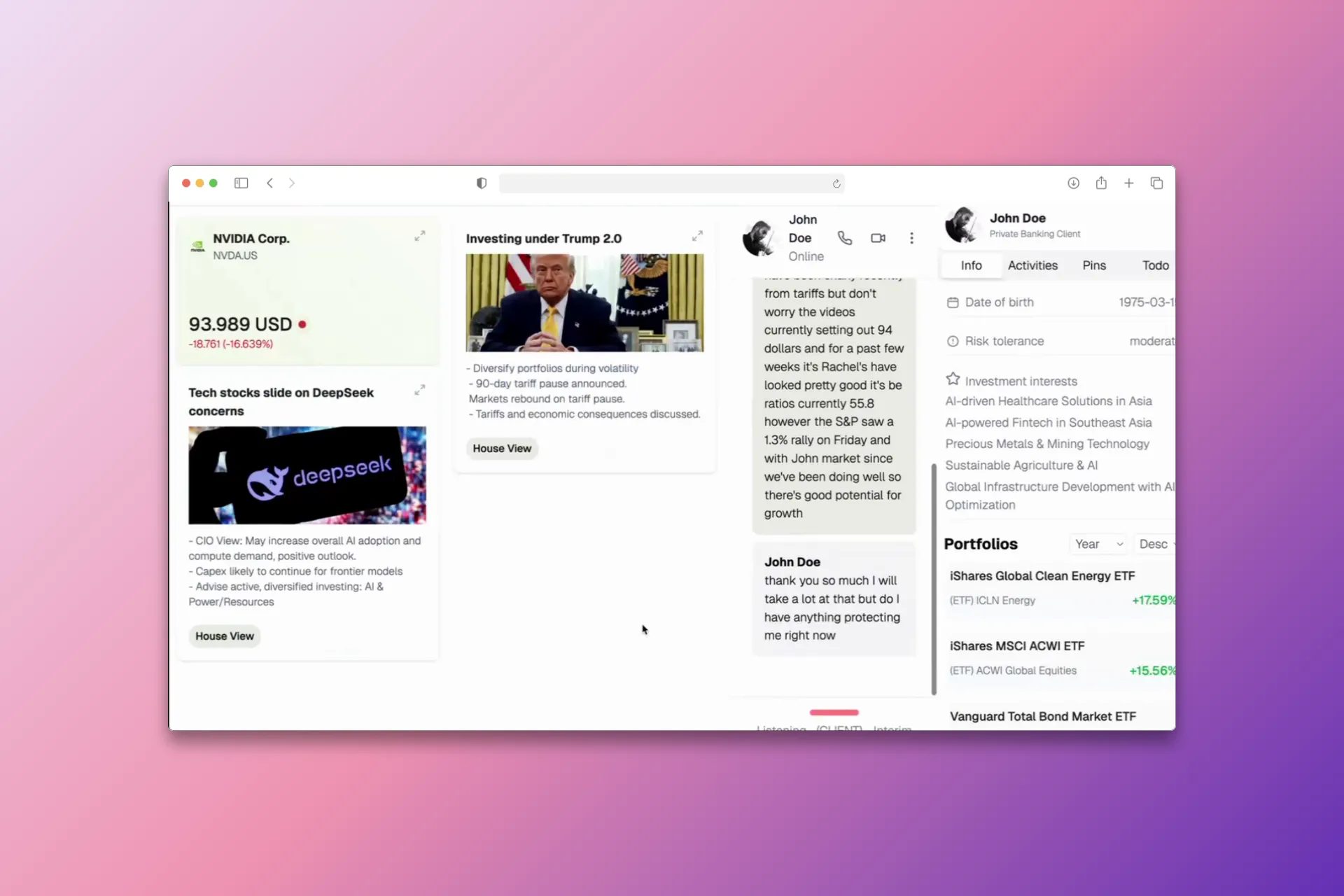

- CallHack - Provides real-time transcription and RAG-powered assistance during live client calls, surfacing relevant information on-the-spot

- TradeShield - Automates pre-trade compliance verification, consolidating checks across multiple systems into a single interface

Technical Innovation

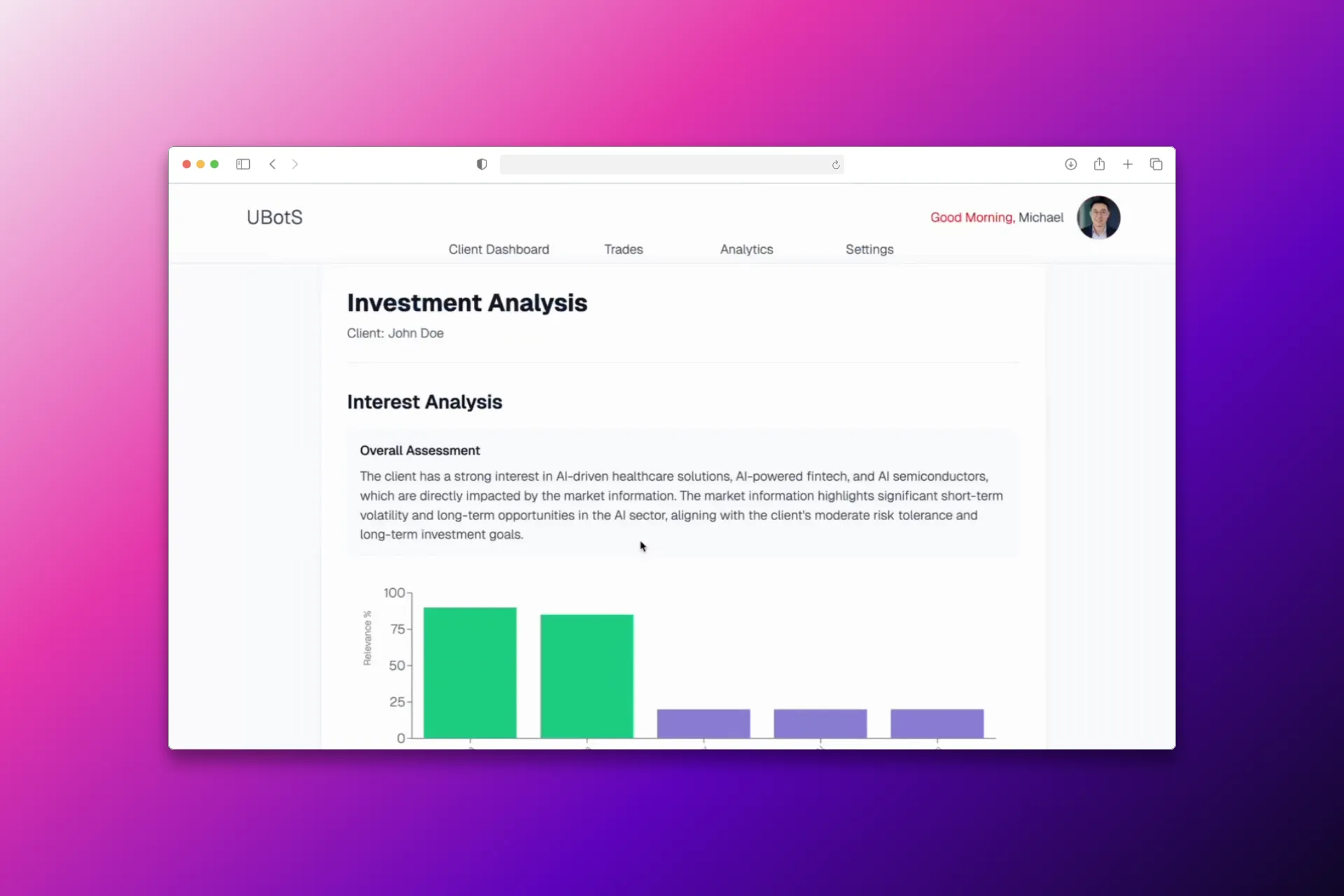

- Multi-agent Architecture: Specialized LLM agents decompose complex analysis tasks, with a manager agent orchestrating specialist agents for better accuracy and reduced hallucination

- Three-level Matching: Balances quality and efficiency through lazy matching, detailed matching, and comprehensive reports

- Real-time Intent Classification: Custom benchmark (CA Bench) developed to evaluate LLM accuracy in classifying client inquiries

- Advanced Prompting: Chain-of-Thought and Tree-of-Thought techniques for transparent reasoning and brainstorming indirect market impacts

- Hallucination Mitigation: Hard-coded sourcing for numerical data and stock information, with multiple evaluator agents

Business Impact Analysis

- 700k+ hours saved annually across the advisor workforce

- 13 hours/week time savings per advisor

- 50% reduction in pre-meeting preparation time

- 10k-20k additional clients capacity enabled

- 49% fewer calls needed to close trades